Perpetual futures open interest (OI) has become the most reliable indicator of systemic trust and liquidity in DeFi.

Unlike TVL, which can be inflated by incentives, or volume, which is often short-lived, OI reflects capital committed and risk sustained.

High and sticky OI signals structural adoption of a venue, and its reflexivity often compounds into ecosystem-wide growth.

1/

OI as the Core Liquidity Signal

1. Capital Commitment: OI measures collateral actively posted in perp markets; a proxy for how much risk traders are willing to hold.

2. Trust in Execution: Traders only leave collateral in venues with strong risk engines, solvency guarantees, and deep liquidity.

3. Reflexivity Loop: Higher OI generates more fees → fees attract market makers → liquidity improves → OI expands further.

This feedback loop makes OI the heartbeat of DeFi: a leading indicator of liquidity health across ecosystems.

2/

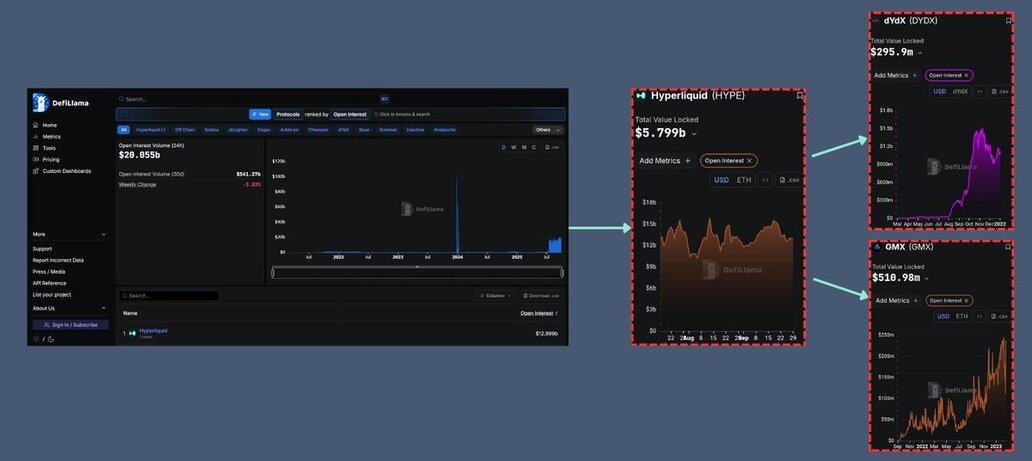

How OI Shaped the Last Cycle

1. @dYdX (2021–22): OI growth signaled the first wave of serious on-chain perp adoption, catalyzing Layer 2 derivatives trading.

2. @GMX_IO (2022–23): On @arbitrum, GMX’s OI expansion during a bear market showed traders trusted its unique GLP liquidity design.

3. @HyperliquidX (2024–25): With billions in OI and negligible incentives, Hyperliquid proved that execution quality > token emissions.

Each case reinforced the thesis: OI expansion = protocol-level legitimacy.

3/

What the Data Says (2025)

Perp venues collectively represent one of the largest and most active sectors in DeFi:

-> Total DeFi Perps OI: $20.05 billion (as of Sept 2025).

-> Leaders: @HyperliquidX, @dYdX, @GMX_IO, @aevoxyz.

Trends:

-> On-chain OI growth is outpacing CEX perp growth in relative terms.

-> LST/LRT collateral integration is driving new margin adoption.

-> RWAs (e.g. tokenized T-bills) are beginning to appear as margin assets.

4/

Why OI > TVL, Volume, Fees

1. TVL: Can be mercenary and inflated by rewards; doesn’t always reflect active usage.

2. Volume: Measures activity, but often cyclical; subject to wash trading.

3. Fees: Lagging indicator; only grows after OI expands.

OI is different:

• It’s forward-looking.

• It represents real capital at risk.

• It compounds with liquidity flywheels.

5/

Catalysts That Could Send OI Higher

1. Cross-margin with Restaking Receipts: LRTs ($ezETH, $rsETH, $uniETH) entering perp markets as margin assets → new leverage loops.

2. Stablecoin Collateral Expansion: Growth of RWA-backed stables feeding margin pools.

3. Agent Liquidity: AI agents increasingly executing intent-based trading will need high-liquidity perp venues with deep OI.

6/ Conclusion

Perps OI is the clearest, most credible measure of liquidity health in DeFi.

It compresses trust, adoption, and reflexivity into one metric, making it the sector’s true heartbeat.

• Where OI expands, ecosystems thrive.

• Where OI flatlines, ecosystems stagnate.

Monitoring perp OI across venues is not just an analytical tool. It’s the leading indicator for where the next cycle’s liquidity will concentrate.

Show original

17.1K

146

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.